Posts

That have a supply, the speed and monthly payment will start aside less than to own a fixed-price home loan, however, both the interest and you may payment per month increases considerably. Common 10-year Hands are 31-year 10/1 otherwise ten/6 Fingers, definition you have a basic repaired-price age a decade, after which, your speed adjusts annually or semiannually for the next 2 decades. If you are planning to go or re-finance inside the a decade, next a great ten/1 otherwise 10/six Sleeve can be optimal. However, for those who don’t flow or refinance, keep in mind that your’ll getting at the mercy of fluctuating prices and much larger monthly premiums while the repaired-rates several months turns for the varying speed several months. Such, a debtor get decide to create a minimum payment per month or amortize dominant and attention money along side complete financing name. Like with other Palms, the initial fixed-rate months eventually turns to your varying several months, if financing costs change sometimes.

Straight down introductory costs

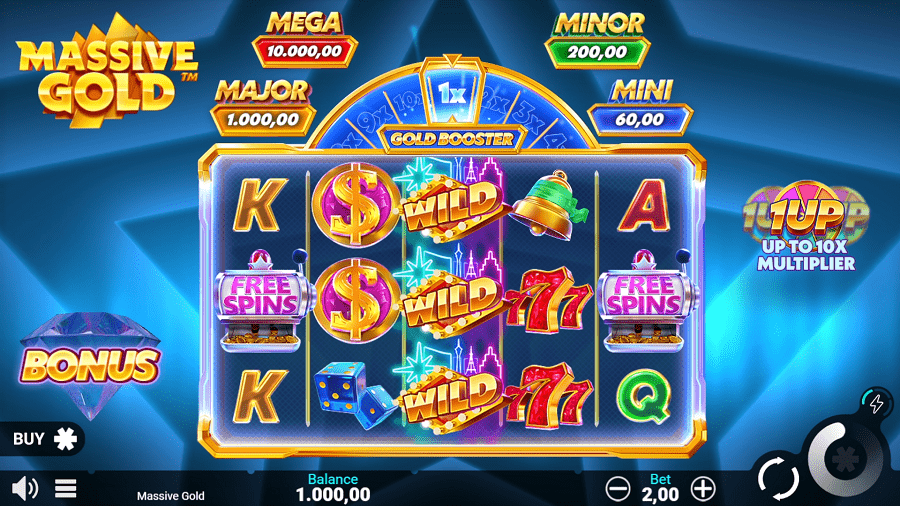

Another area the place you have manage ‘s the freedom to shop https://gamblerzone.ca/casino-winward-25-free-spins/ and you may evaluate loan providers to consider an informed prices and terminology. All the household lending options try at the mercy of credit and you can property acceptance. Costs, system small print is at the mercy of alter without warning.

Ways to get a decreased Arm Speed

Including, if the mortgage is for $a hundred,000 from the an interest rate from 4 percent, one consumer provides offered to spend $cuatro,100000 each year she or he borrows otherwise owes one to complete matter. Homeowner’s insurance rates covers losings and you will damage to your residence in the event the something unforeseen goes, such as a flames otherwise theft. When you have a mortgage, the financial would like to ensure that your property is covered by insurance rates. That’s as to the reasons loan providers essentially want proof you have citizen’s insurance.

The experience-to-pay back code ‘s the realistic and you can good faith determination really lenders have to generate that you are able to spend right back the loan. Create Netflix now and select from numerous percentage possibilities. This paid back membership sort of ChatGPT brings reduced effect times, availableness while in the peak times plus the capacity to test out the newest has early. OpenAI declares the discharge of the o1 model, and this demonstrates complex need possibilities. To start up the start of its o1 design family members, OpenAI along with declares the fresh restricted discharge of their o1-examine and you may o1-micro habits.

Getting ready for Price Variations Times

Check if your servicer charges any charge to possess a bi-weekly commission package. You’re capable to do a similar objective without having any commission by simply making a supplementary month-to-month mortgage repayment annually. A great 5/step 1 varying rate mortgage (ARM) otherwise 5-season Arm try a mortgage loan where “5” ‘s the while your first rate of interest will stay repaired.

Know and get ready for transform to the varying-rates home loan. The proper out of rescission is the correct of a customers in order to terminate certain kinds of fund. While you are to find a house that have home financing, there is no need a straight to terminate the mortgage once the fresh closure data files are signed. However, while you are refinancing a home loan, you have got until midnight of your 3rd working day pursuing the deal to rescind (cancel) the mortgage bargain. Effective obligation servicemembers could be provided permanent changes out of station (PCS) requests.

- Individual revealing enterprises, called credit reporting enterprises, assemble boost information about your own credit score and offer it to many other companies, that use it create behavior about you.

- A deed-in-lieu away from foreclosures try an arrangement for which you willingly start possession of your property to the financial to prevent the fresh property foreclosure techniques.

- To start with considering OpenAI’s GPT-3 structures, ChatGPT has changed.

- The primary ‘s the amount of a mortgage that you need to pay straight back.

- The fresh model could have been trained due to a variety of automatic studying and you will human opinions to generate text one closely fits that which you’d expect to see in text message published by a person.

Edit, Convert and you will Describe Content

If the dominating fee are printed after this happened, it will be incorporated next time your own interest rate changes. An excellent Va mortgage try financing system supplied by the brand new Agency away from Pros Items (VA) to aid servicemembers, experts, and you will eligible thriving partners purchase belongings. The fresh Virtual assistant cannot improve fund however, establishes the principles for which can get be considered as well as the financial words. The new Virtual assistant guarantees an element of the financing to reduce the brand new risk of loss on the bank. Your home loan servicer is the business you to definitely supplies you with your mortgage comments. The servicer along with handles your day-to-date jobs away from dealing with your loan.

Discover where you are able to score information regarding deposit apps and has. A housing mortgage is often a primary-identity loan that provide finance to pay for price of strengthening or rehabilitating a house. If a loan provider usually trust in a specific income source otherwise count with regards to your for a financial loan can occasionally rely upon whether or not you could potentially relatively expect the money to carry on. You can mix some other methods out of transportation, including driving, ride-sharing, or cycling which have transportation for a passing fancy excursion.

Qualifying is often according to a glance at the customer’s credit and earnings, like being qualified to have another financial. Lender’s name insurance policies covers their lender up against difficulties with the brand new name to your property-such as people that have an appropriate claim contrary to the family. Lender’s name insurance coverage just covers the lending company facing problems with the newest name. To safeguard oneself, you can also buy manager’s identity insurance.