Hedging Betting Exposure Using Crypto: A New Frontier

In the fast-evolving world of online gambling, bettors are constantly looking for ways to minimize their risks and maximize their profits. One innovative method that has gained traction in recent years is the use of cryptocurrencies to hedge betting exposure. Crypto offers unique advantages, including enhanced anonymity, reduced transaction fees, and the ability to operate on decentralized platforms. Understanding how to effectively leverage these digital assets can revolutionize your betting strategy. To explore these opportunities and learn more about hedging, visit Hedging Betting Exposure Using Crypto Derivatives Bitfortune.

Understanding Betting Exposure

Betting exposure refers to the total amount of risk a bettor takes on a particular wager. This can include the potential losses that may occur if the bet does not go in the bettor’s favor. Managing betting exposure is crucial for long-term success in gambling, as it helps ensure that gamblers do not encounter devastating financial losses. Traditional methods of hedging involve placing counter-bets on different outcomes to reduce the risk of losing money on any single wager. However, the introduction of cryptocurrency has opened new avenues for bettors to manage exposure more effectively.

The Role of Cryptocurrency in Betting

Cryptocurrency, notably Bitcoin and Ethereum, has become increasingly popular among online gamblers due to its decentralized nature and the security features inherent in blockchain technology. Unlike traditional currencies, cryptocurrencies are not subject to the same regulatory constraints or transaction fees, making them an attractive option for betting. Additionally, cryptocurrencies can provide a layer of anonymity that traditional payment methods cannot offer, allowing bettors to place wagers without revealing sensitive information.

Hedging with Crypto: How It Works

When bettors use cryptocurrencies to hedge their betting exposure, they essentially create a strategy that allows them to balance their potential losses. This involves placing strategic bets on different outcomes using crypto while monitoring market fluctuations. Here’s how this might look in practice:

- Identifying Opportunities: Bettors analyze various betting markets and identify opportunities where they can leverage crypto to place opposing bets. For instance, if a bettor places a significant wager on Team A to win an upcoming match, they might simultaneously place a smaller wager on Team B, using cryptocurrency.

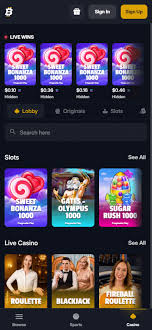

- Utilizing Different Platforms: Many online betting platforms now accept cryptocurrencies, allowing bettors the flexibility to explore various betting opportunities across different sites. This diversifies risk and helps minimize exposure.

- Adjusting Bets in Real-Time: The crypto market is highly volatile, and odds in betting markets may shift quickly. Bettors can adjust their crypto bets in real-time, capitalizing on favorable odds to mitigate potential losses.

Advantages of Hedging with Cryptocurrencies

Utilizing cryptocurrencies for hedging betting exposure offers numerous advantages:

- Lower Transaction Fees: Crypto transactions often have significantly lower fees compared to traditional banking methods, allowing bettors to preserve more of their funds.

- Enhanced Anonymity: The use of crypto allows bettors to maintain their privacy, protecting sensitive information from being disclosed.

- Quick Transactions: Cryptocurrencies facilitate faster deposits and withdrawals, enabling bettors to react quickly to changing betting markets.

Risks and Considerations

While there are significant benefits to using cryptocurrencies for hedging, some risks must also be considered:

- Market Volatility: The value of cryptocurrencies can fluctuate wildly, and this volatility can impact the effectiveness of a hedging strategy.

- Regulatory Environment: As the cryptocurrency landscape is still evolving, regulatory changes could affect the legality and acceptance of crypto in betting.

- Security Risks: While blockchain technology is inherently secure, the risks associated with digital wallets and exchanges can expose bettors to loss if not managed properly.

Practical Steps to Start Hedging with Crypto

If you’re interested in leveraging cryptocurrencies to hedge your betting exposure, here are some practical steps to get started:

- Research Cryptocurrency Options: Understand the different cryptocurrencies available and choose one that fits your betting strategy.

- Select a Reputable Betting Platform: Find online bookmakers that accept crypto and review their terms, focusing on withdrawal limits, fees, and available betting markets.

- Develop a Betting Strategy: Create a robust strategy that combines traditional betting approaches with crypto wagers, allowing for hedged positions.

- Monitor the Markets: Continuously track both betting odds and cryptocurrency prices to inform your real-time betting decisions.

- Practice Responsible Gambling: Always gamble within your means and be aware of the risks associated with betting and cryptocurrency investments.

Conclusion

Hedging betting exposure using cryptocurrency represents an innovative solution for gamblers seeking to manage risk while enjoying the dynamic world of online betting. By leveraging the unique advantages that cryptocurrencies offer, bettors can create a more balanced betting approach that enhances their chances of long-term success. However, it is essential to remain aware of the risks involved and take a strategic approach to both betting and cryptocurrency investments. As the gaming landscape continues to evolve, those who adapt to these changes will likely find themselves at a distinct advantage.